QUESTION

1) When does one have to reset their zakaat date? As far as i am aware the only figures that matter are the figure at the start and end of zakaat year and whether they are above/equal to or below nisaab. What happens if you go below nisaab during the year.

2)In terms of salaries do we calculate zakaat on yearly gross salary? Or just whatever cash we have left at end of zakaah date.

3)Things like income tax and NI contributions, do we remove this before calculating zakaat if we calculate it based on yearly salary?

ANSWER

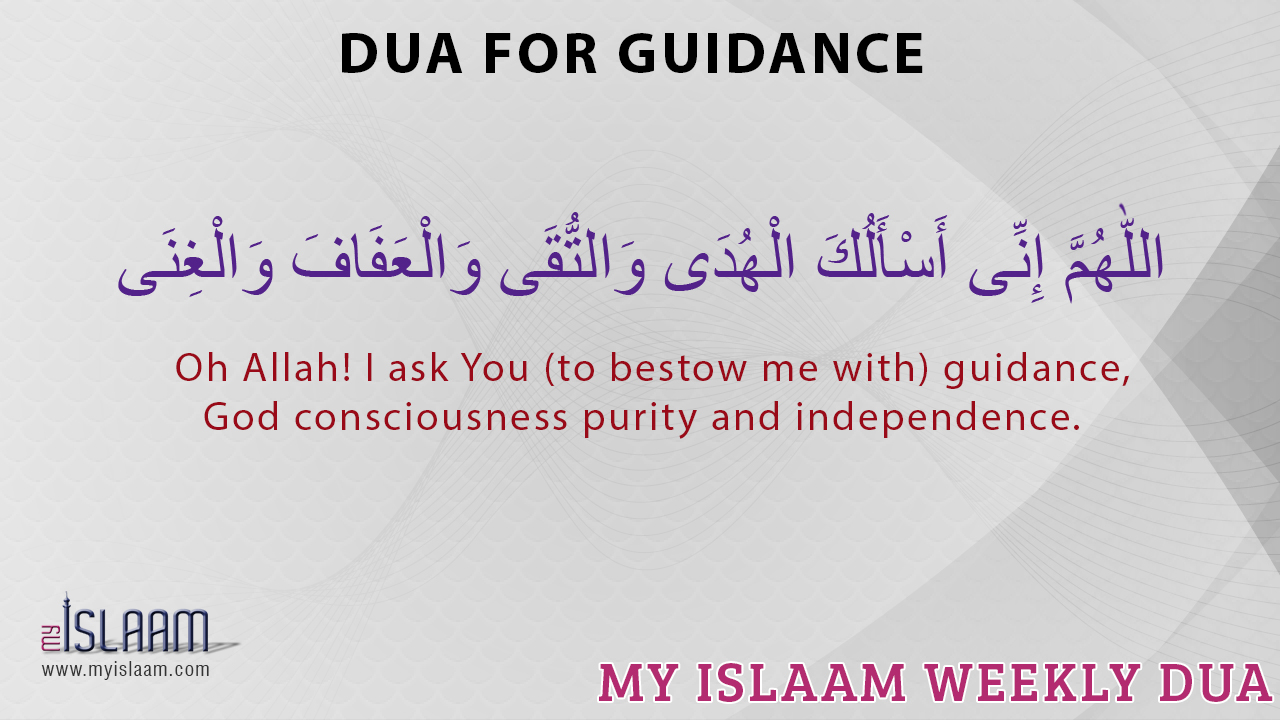

In the name of Allah, Most Compassionate, Most Merciful,

1) In principle, one’s zakāt year starts when his/her zakātable items first equal or exceed the niṣāb. Thereafter, zakāt is due when one complete lunar year has elapsed and every lunar year subsequently, on that very same date if one is owner of niṣāb or more than niṣāb. That date is considered as one’s zakāt anniversary. It does not matter what happens during the year in terms of fluctuation of zakātable items.

However, if one’s net wealth reduces him/her to zero or below zero (when one incurs debt), the zakāt date will be reset to when he/she becomes owner of zakātable items once again that are equivalent to niṣāb or more.

2 & 3) Whatever zakātable items one has on his/her zakāt anniversary date.

And Allah, the Almighty, knows best

Mufti Sufyan

O you who have Imaan! Seek help by means of patience and Salaah (prayer). Verily Allah is with those who exercise patience.

O you who have Imaan! Seek help by means of patience and Salaah (prayer). Verily Allah is with those who exercise patience.